Case study

Distressed Assets

Facilitate complex decisions on non-performing-loans (NPL) evaluation by means of an accurate pricing procedure.

1 UI Designer

2 Data Visualisation Engineers

2 Solutions Architects

2 Domain Experts

1 Project Manager

Problem

Solving NPL problems by leveraging high-quality data.

One of the missions of the commercial banking sector is to support the sustainable economic and social development of communities and territories.

However, the economic performance of commercial banks may suffer when a consistent proportion of their clients experience financial or operational distress and are therefore unable to meet their financial obligations. The European Central Bank’s definition of a suitable operating model is based on a highly granular analysis of a bank’s NPL portfolio that clearly defines borrower segments. A necessary precondition for this analysis (portfolio segmentation) is the development of appropriate solutions with sufficiently high-quality data.

Portfolio segmentation enables banks to group borrowers with similar characteristics and apply similar approaches to issues such as restructuring and liquidation. Customized processes are designed by teams that are dedicated to each segment. Alternatively, banks may sell specific NPL segments to external investors who purchase distressed debt at a discount as a key investment strategy.

Solution

UX research for realizing effective NPL portfolio sales.

The introduction of a simpler and more accurate NPL evaluation process requires both dynamic selection criteria and comprehensive portfolio metrics based on information completeness and atomic-level data.

Since 2017, Nextbit has been involved in designing solutions to address the core business problem of distressed asset management. By using DAMneat, a tool we developed for solving NPL problems, analysts can accurately rank and prioritize an entire portfolio based on both book value and information quality. Specific selections can be made to evaluate specific segments or initiate a data remediation process.

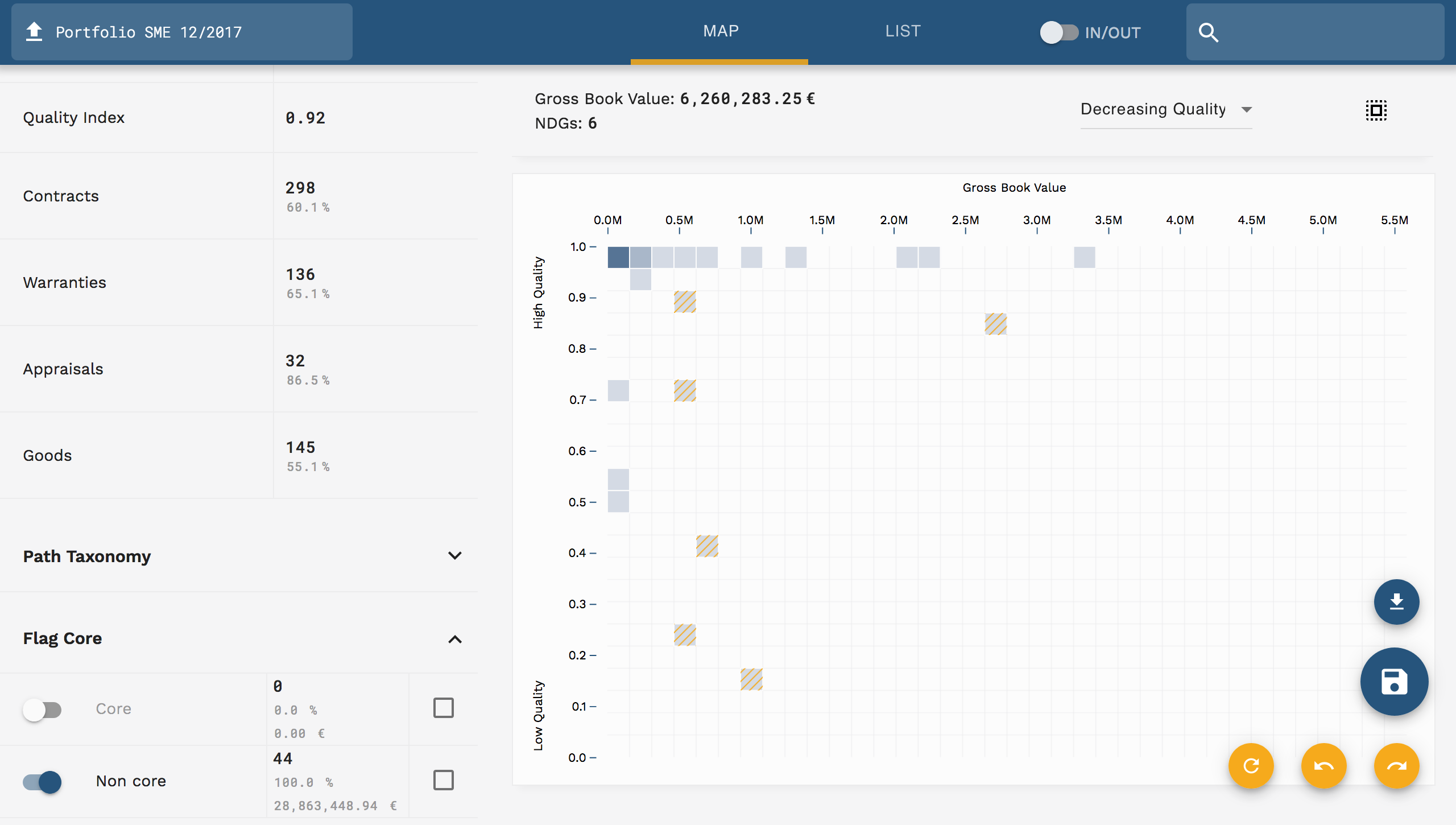

Assets data quality overview

Specific data visualisation algorithms highlight data quality elements that impact the portfolio economic evaluation.

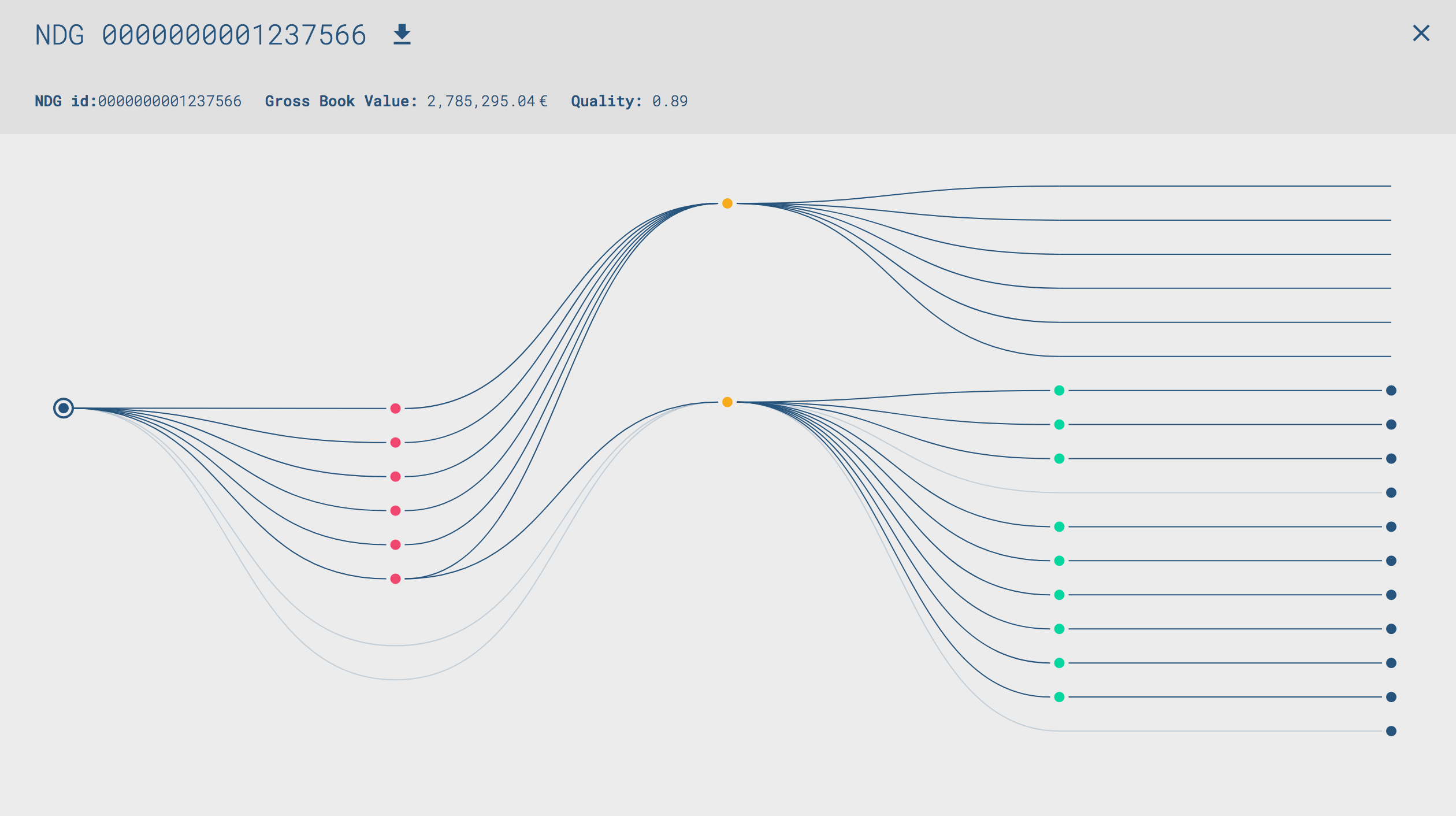

Assets data quality detail

The analyst is given immediate evidence of key economic indicators and data quality issues for the asset under evaluation.

Facilitate data remediation

Discern data loss from exceptions viewing relationships between main entity types like: contracts, warranties, appraisals, with the ability to distinguish between anomalies and legitimate missing information.

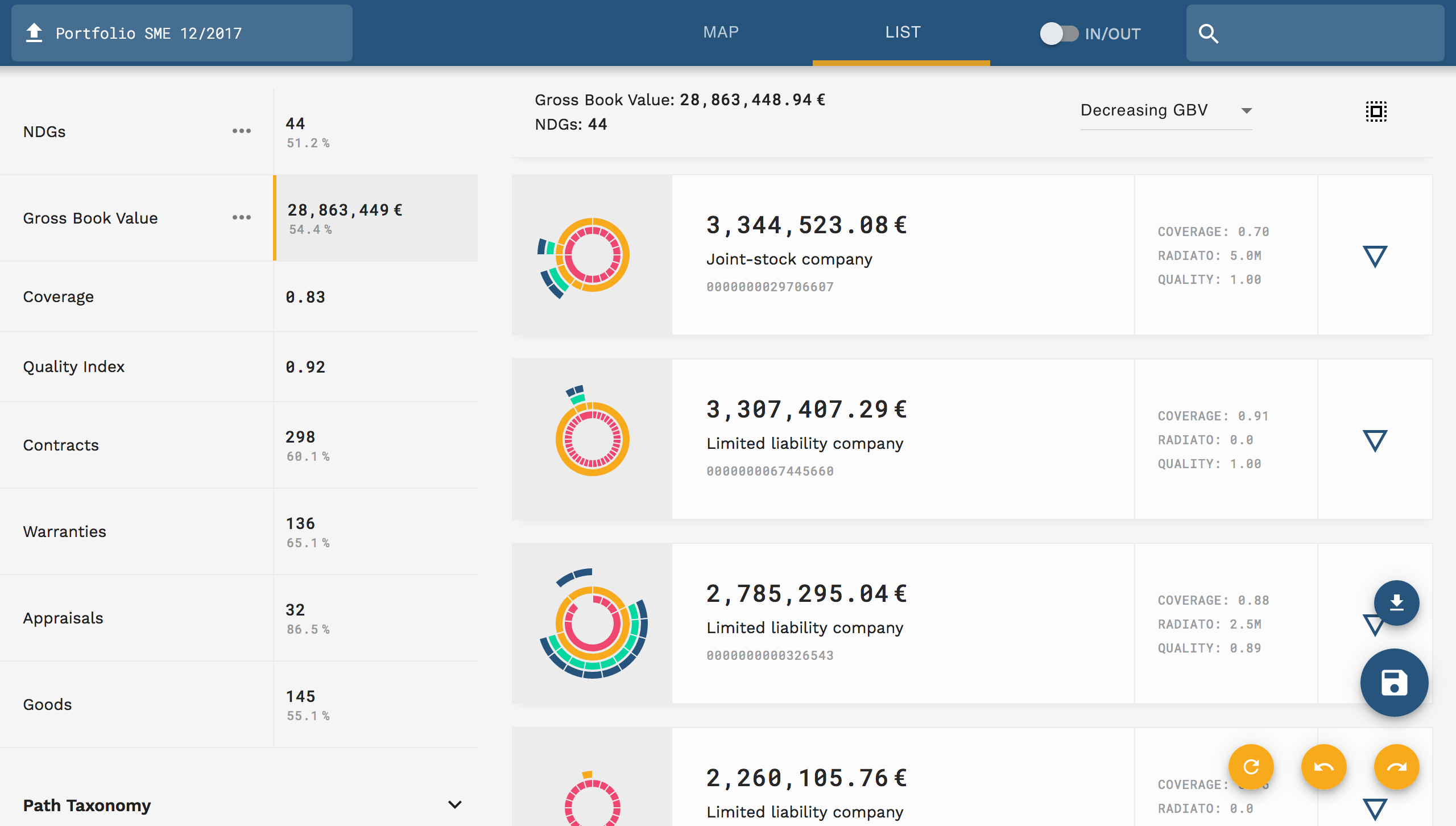

Guiding analysts during the economic evaluation of distressed assets.

Centred on a user experience specific to the NPL domain, our solution improves the user’s ability to price distressed assets by leveraging detailed visual representations of data quality, atomic-level data and segmentation indicators. This precise and intuitive exploration of selected portfolio segments provides analysts with more efficient and accurate economic evaluations of each NPL segment.

Analyse economic metrics

Analysts have a clear ranking/prioritization of the entire portfolio based on both book value and information quality. Specific selections can be made to either sell or start a remediation process.

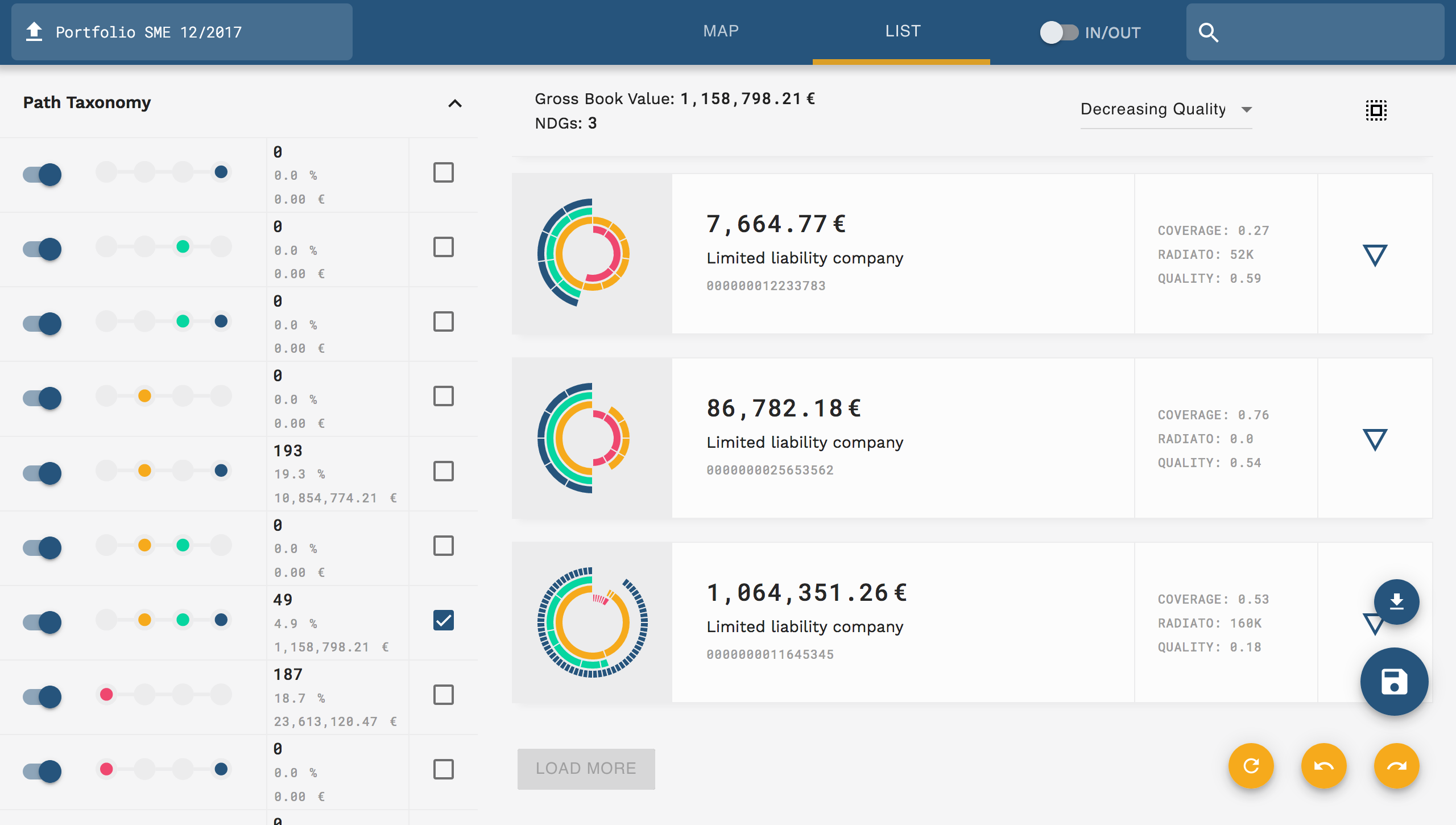

Explore portfolio segments

The interactive UI allows for the simulation of various sales scenarios, evaluating the economic impact at each step of the process.

towards the future

Improve your current process

The role of Nextbit is to support and facilitate complex decisions by means of a better informed process.

The goal has been reached through the research end development of an user experience that provides tailored and out-of-the-box process-core functionalities. The entire NPL sales cycle is boosted by a faster remediation process, keeping the operational risk low and resulting in an higher NPL evaluation, a result based on the accurate pricing procedure.

Effective NPL portfolio sales

The pricing evaluation of distressed debt is determined by the information given to investors, thus data quality is a fundamental aspect correlated to the value of distressed portfolios.

Find out how Nextbit can empower your team today

Drop us a line at contact@nextbit.it